Navigating compliance in the business world can feel daunting. The Beneficial Ownership Information (BOI) reporting requirements, introduced under the Corporate Transparency Act (CTA), are now a crucial focus for businesses across the U.S. Here’s an easy guide to help you understand and meet these new requirements without stress, so you can stay focused on growing your business.

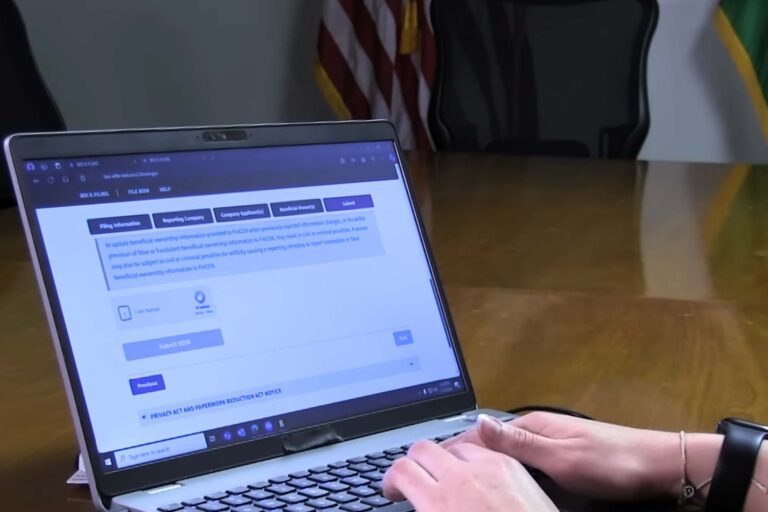

BOI reporting is a new mandate requiring certain businesses to disclose information about their beneficial owners—those who own or control the company directly or indirectly. Implemented by the Financial Crimes Enforcement Network (FinCEN), this initiative combats illicit activities like money laundering and fraud while promoting corporate transparency.

For small and medium-sized businesses, including those handling payroll or financial data, compliance isn’t just about following the rules. It’s about protecting your reputation, building trust, and aligning with industry standards. By adhering to BOI reporting, businesses show accountability, which can improve customer and partner relationships.

Additionally, the financial landscape is evolving, and many regulatory changes are designed to safeguard business owners and the economy at large. Understanding BOI reporting ensures that your business operates with integrity and contributes to these broader goals.

Most U.S. corporations, LLCs, and similar entities are required to file BOI reports unless they meet specific exemptions, such as being already heavily regulated or qualifying as larger entities. For the majority of businesses, compliance is mandatory.

Exemptions often apply to publicly traded companies, government entities, and certain financial institutions. However, small to medium-sized businesses, especially those formed after January 1, 2024, are more likely to need to file. Ensuring compliance early can save time and resources down the line.

The BOI reporting process is straightforward. Businesses must disclose:

Submitting accurate and timely information is critical, as errors or delays can result in significant penalties. Even minor inaccuracies, such as misspelled names or outdated addresses, can lead to delays and potential fines. Regularly updating your records and cross-checking information before submission can prevent such issues.

While compliance may seem like an extra task, it has benefits beyond legal adherence:

By taking BOI reporting seriously, businesses position themselves as reliable and credible within their industries. This proactive approach not only avoids penalties but also strengthens your reputation with stakeholders who value transparency and accountability.

Compliance doesn’t have to be overwhelming. Use these resources to start:

● FinCEN’s BOI Reporting Page: A detailed guide to the reporting process.

● BOI Compliance Guide: A downloadable, step-by-step resource for businesses.

These tools provide a solid foundation for understanding and navigating the requirements. Additionally, consulting with a professional service, like BMA Payroll, can streamline the process, ensuring every detail is managed accurately.

At BMA Payroll, we specialize in simplifying compliance. From BOI reporting to payroll management and regulation updates, we’re here to ensure your business stays ahead of the curve.

Our team offers tailored guidance, helping you navigate the complexities of BOI reporting. We understand that every business is unique, and our solutions are designed to fit your specific needs. By partnering with us, you can confidently handle compliance while focusing on core operations.

Let us handle the complexity of compliance, so you can focus on what you do best—running your business. Contact us today to learn how we can support your goals.